Employers brace for increased costs after UVA changes insurance policy

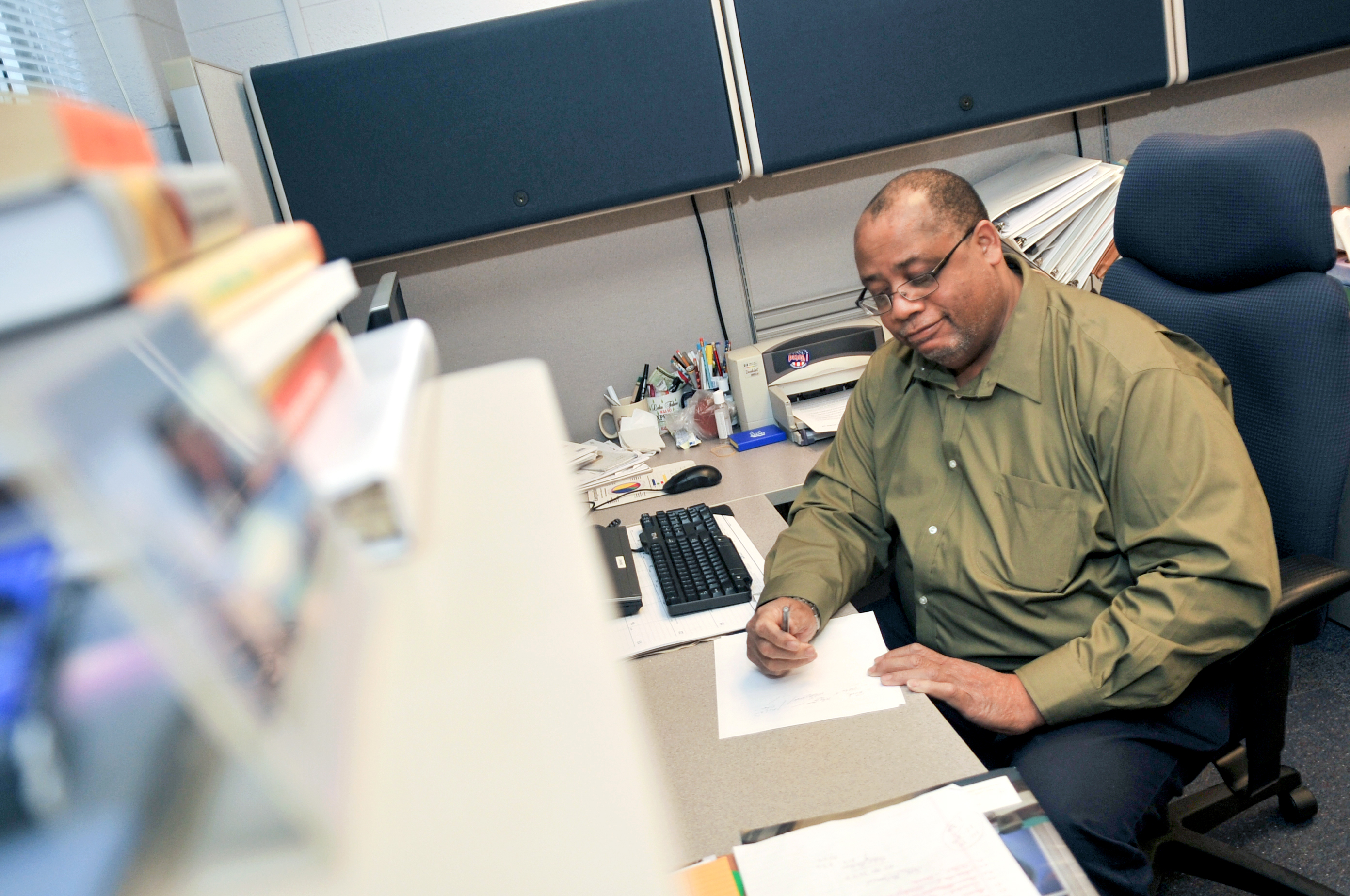

Galloway Beck, director of human resources for the City of Charlottesville, says UVA’s decision to end coverage for the working spouses of employees could cost the city $180,000 next year. Photo: Elli Williams

Support C-VILLE Weekly

C-VILLE Weekly is Charlottesville’s leading newspaper. Founded in 1989, it’s been the area’s local source for informative (and informed) stories in news, arts, and living for more than 26 years.

UP NEXT

In brief

The Big Picture

Hall pass

Songs and stories

IN CASE YOU MISSED IT

In brief

The Big Picture

Hall pass

Songs and stories

PUBLICATIONS

C-VILLE Weekly | April 24, 2024

C-VILLE Weekly | April 17, 2024

C-VILLE Weekly | April 10, 2024

C-VILLE Weekly | April 3, 2024

Real Estate Weekly | April 24, 2024

Real Estate Weekly | April 17, 2024

Real Estate Weekly | April 10, 2024

Real Estate Weekly | April 3, 2024

Abode | Spring 2024

Knife & Fork | Spring/Summer 2024

Fine Properties | Spring 2024

Weddings | Fall/Winter 2023

Best of C-VILLE 2023

We Are C-VILLE | March 2024

Summer Camp Guide | March 2024

National Nonprofit Day | August